«Set liquidity on the cryptocurrency market: understand the importance of platforms and trading wallets»

The cryptocurrency market is known for its volatility and its rapid changes in prices, which makes it essential to have a solid understanding of the way of navigating in this complex space. Two key aspects that can have a significant impact on an investor’s experience are trading platforms and wallets. In this article, we will immerse ourselves on the importance of liquidity, CEX (exchanges of cryptocurrency) and forks.

What is liquidity?

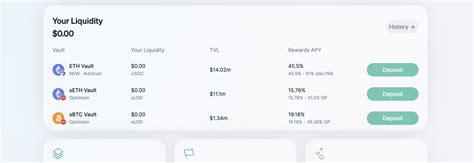

Liquidity refers to the capacity of an asset to be easily purchased or sold on a market without allocating its price. In other words, this is the ease with which you can liquidate your assets if necessary. High liquidity means that there are many buyers and sellers available for a cryptocurrency or a particular token, which facilitates purchase or sale without significant price fluctuations.

The importance of liquidity on the cryptocurrency market

Liquidity plays a crucial role in the cryptocurrency market, because it affects the global conviviality of the various assets. When a trading platform or a portfolio offers high liquidity, investors can easily enter and get out of transactions, reducing their exposure to market volatility. This is particularly important for beginners who may not have an in -depth understanding of the markets.

CEX (Crypto-money exchanges)

A CEX is a digital platform that allows users to buy and sell cryptocurrencies like Bitcoin or Ethereum. Some popular CEX include Coinbase, Binance and Kraken. When selecting a CEX, it is essential to take into account factors such as costs, safety measures, user experience and the number of cryptocurrencies withdrawn.

CEX can be classified into two main types:

* Decentralized exchanges (DEX) : These are peer exchanges that operate without central authority. They often have lower costs than CEXs but can offer more features.

* Centralized exchanges (CEX) : these are traditional exchanges where users can buy and sell cryptocurrencies by themselves.

Provide

A fork is a fundamental change in technology or the underlying protocol of a cryptocurrency, resulting in two distinct branches. This can happen when a developer creates a new version with different objectives or features while maintaining the original code base. The forks are not uncommon in the cryptocurrency space and have led to interesting results.

The impact of forks on liquidity

When a fork occurs, it can affect liquidity if the new protocol is less popular among traders or investors. This can lead to a reduction in purchase and sales volumes, resulting in a drop in the prices of assets already available. In addition, a fork can create uncertainty among users, which hesitates them to use the platform.

Best practices to manage liquidity

To effectively manage liquidity, consider the following strategies:

* Diversify your wallet : Divide your investments over several cryptocurrencies or tokens to minimize exposure to a single asset.

* Use renowned exchanges : Choose well -established and secure CEXs that offer reliable liquidity.

* Monitor market trends

: Stay informed of market developments and adjust your strategy accordingly.

Conclusion

Liquidity is an essential aspect of the cryptocurrency market, influencing negotiation decisions and the global experience of users. Understand how to navigate the platforms, wallets and high exchanges can help investors make informed choices and minimize risks. By recognizing the importance of liquidity, CEX and forks, you will be better equipped to succeed in the world in constant evolution of cryptocurrencies.