Impact of risk assessment on Monero trading (XMR): Key Reflections for Cryptocurrency investors

Cryptomena, including Monero (XMR), have experienced significant growth and volatility over the past decade. As a result, investors have been bombarded with many business strategies and investment opportunities in this fast -developing market. One of the key aspects to be considered when trading XMR is the risk assessment – the process of assessing potential risks and rewards associated with investment. In this article, we will dive into the importance of the risk assessment in Monero (XMR) and examine how this may affect your investment decisions.

Why depends on the risk assessment

Risk assessment is not just a theoretical concept; It is a fundamental aspect of successful investment in cryptomena. When you invest in XMR or any other cryptocurrency, you are exposed to various risks that can lead to significant losses. These risks include:

1

- Liquidity risks

: Cryptomen exchange trading may be volatile, leading to problems with liquidity and potential loss if you cannot sell your coins at a fairly or reasonable price.

- Security risks : Cryptocurrency exchange and wallets often do not have adequate security measures, which makes it easier for hackers to steal funds.

- Regulatory Risks

: CHANGES AND CRUPTOMS CHALLERS AT ACCESSORIES may have an impact on the value of XMR or other assets.

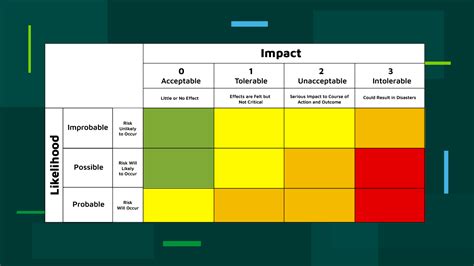

Understanding risk assessment

Risk assessment is an essential part of Monero trading (XMR). Includes evaluation of various factors that can affect the price of cryptocurrencies, including:

1.

- Market sentiment : Emotions of investors, such as fear, greed or euphoria, can increase price movements.

- Network effects : Decentralized Monero network and powerful security functions contribute to the rate of adoption.

- Competition : XMR faces the competition of other cryptocurrencies that may affect its market share.

Strategies to evaluate risk

In order to alleviate risks in trading with XMR, investors must be aware of the following strategies:

1.

- Stop Orders : Set the stop order to automatically sell coins if they drop below a certain price level.

- Diversification : Expanding investments in various cryptocurrencies, markets and asset classes to minimize the issue of one investment.

- Regular monitoring : constantly monitor the prices of XMR, market sentiment and business activity to make informed decisions.

Proven practices to assess risk

To ensure an effective risk assessment when trading Monero (XMR), consider these proven procedures:

1.

- Stay informed : Follow renowned sources such as coindesk or cryptoslate, for market messages and updates.

- Set clear goals : Define your investment goals and risk tolerance before starting the business trip.

- Keep records : Follow your stores including losses, profits and all major events.

Conclusion

Risk assessment is a critical aspect of Monero (XMR) trading or any other cryptocurrency. By understanding the potential risks associated with XMR and implementing effective risk management strategies, you can minimize losses and maximize your revenues on this rapidly developing market. Be sure to stay informed, set clear goals and constantly follow your stores to make informed decisions.