The system allows businesses to track their finances more effectively, making better, informed decisions. A double-entry accounting software program helps you keep track of your financial transactions and typically includes features like a general ledger, accounts receivable and payable, and a trial balance. This program can identify revenue and expenses, calculate profits and losses, and run automatic checks and balances to notify you if something needs your attention. One such case is Company X, a manufacturing company that decided to adopt dual effect accounting to streamline its procurement process.

How do I document transactions using double entry accounting?

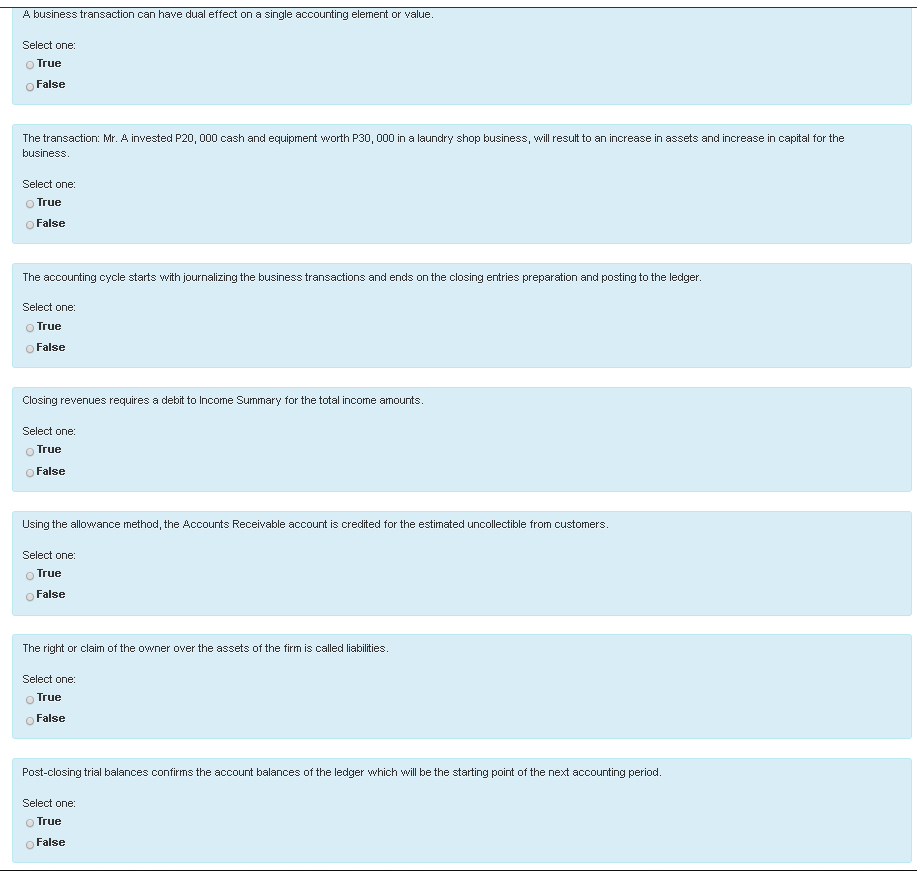

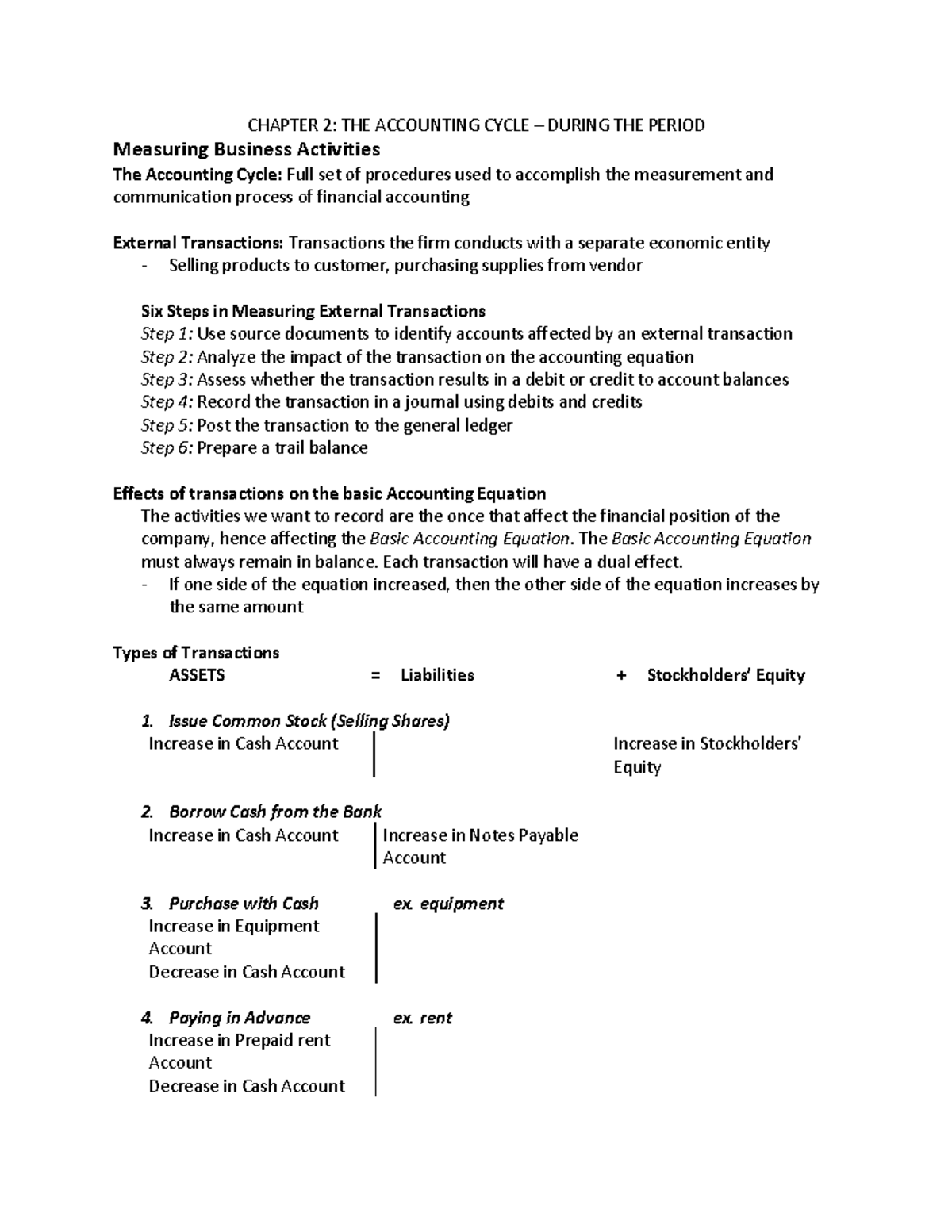

A trial balance is a report that lists all the balances of the general ledger accounts, ensuring that the total debits equal the total credits. This step acts as a checkpoint in the accounting cycle, allowing accountants to identify and correct any errors before proceeding to the next phase of preparing financial statements. The accounting equation lays the foundation for financial statements including the balance sheet. On the balance sheet, the listed assets must equal the sum of all total liabilities and equity.

Accounting software

This process not only enhances the accuracy of financial statements but also fosters a culture of precision in financial record-keeping. Bookkeeping and accounting are ways what is the energy tax credit for 2020, 2021 how to claim and qualify of measuring, recording, and communicating a firm’s financial information. A business transaction is an economic event that is recorded for accounting/bookkeeping purposes.

Double-Entry Accounting Concept

Each entry shows how the transaction affects your business in two different ways. Any increase in expense (Dr) will be offset by a decrease in assets (Cr) or increase in liability or equity (Cr) and vice-versa. You can find out more about double-entry accounting and how to record journal entries in our guides. Auditors will only accept accounting records drawn up with the double-entry accounting method, so it’s important to understand the dual aspect concept. Both sides of the equation must be represented in a business’s financial accounts.

However, even if you’re not required to use a double-entry system, you can benefit from it, especially if you have to deal with payroll tax or self employment tax. The above mentioned explains in detail the dual aspect concept in accounting concepts with examples. For example, if someone transacts a purchase of a drink from a local store, he pays cash to the shopkeeper and in return, he gets a bottle of dink.

Looking ahead, the future of dual effect accounting in procurement appears promising. As businesses continue to focus on strategic sourcing and supply chain optimization, there will be an increasing demand for accurate financial insights into these processes. Dual effect accounting provides a framework for capturing this information and leveraging it to drive better decision-making. Additionally, dual effect accounting facilitates compliance with legal regulations such as tax requirements. It ensures that all financial transactions are properly recorded and reported according to accounting standards.

Double entry is the language of accountancy and it is critical to both your studies and your career that you become familiar with its workings. This document outlines what is being purchased, quantity needed, price agreed upon, delivery date expectations, and terms of payment. Once received by the supplier, they prepare an invoice detailing the items provided along with their cost.

- Additionally, leveraging technology such as automated reconciliation tools can help streamline the process of matching invoices, purchase orders, and receipts across different systems.

- As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings).

- If an organization were not to observe the dual aspect concept, it would use single-entry accounting, which is essentially a checkbook.

- We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation.

- Using online accounting software like Xero can help simplify this process.

Debits and credits are fundamental concepts in accounting and finance used to record and track the financial transactions of a business or individual. They are part of the double-entry bookkeeping system, which ensures that every transaction has equal and opposite effects on different accounts. This system forms the basis for accurate financial recording and reporting. Implementing dual effect accounting in procurement can bring various advantages to organizations. It provides a clear and accurate view of financial transactions by recording both the debit and credit aspects. This ensures transparency and helps in detecting any errors or discrepancies that may occur during the procurement process.

It provides a framework for businesses and individuals alike to maintain transparent, accountable, and comprehensive financial records. The method’s ability to detect errors and its role in building trust among stakeholders make it an indispensable tool in the realm of finance. This was achieved by classifying routine costs as capital expenditures, which allowed the expenses to be spread out over several years rather than being recognized immediately. In summary, balancing accounts and utilizing the trial balance are integral steps in the double entry accounting process. They provide mechanisms for error detection, ensure accuracy, and contribute to the overall reliability of financial information used for decision-making and reporting.

If an organization were not to observe the dual aspect concept, it would use single-entry accounting, which is essentially a checkbook. A checkbook cannot be used to derive a balance sheet, so an entity would be limited to the construction of a cash-basis income statement. Although the dual aspect concept is superior, it takes a lot more time and is much more complicated. It is why small organizations and individuals still use single-entry accounting.

The scandal also led to a loss of trust in corporate governance, auditors, and financial reporting practices. Originating during the Renaissance period in Italy, this method had a transformative shift from rudimentary single entry systems to a more systematic approach, paving the way for transparent and accountable financial management. For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount. Double-entry bookkeeping was developed in the mercantile period of Europe to help rationalize commercial transactions and make trade more efficient. Some thinkers have argued that double-entry accounting was a key calculative technology responsible for the birth of capitalism. This concept is only applicable in cases where there are no income or expenses of a non-recurring nature, like dividends.