The importance of market depth in cryptocurrency trade: a study on Ethereum

In the world of cryptocurrency, the market depth plays a crucial role in determining the volumes and commercial prices of several assets. While many dealers focus on price movements, the underlying dynamics of the market depth can have significant effects on the commercial performance of a financial value such as Ethereum (Ethle). In this article we will examine how the market depth influences ETH trade and provide information about its importance.

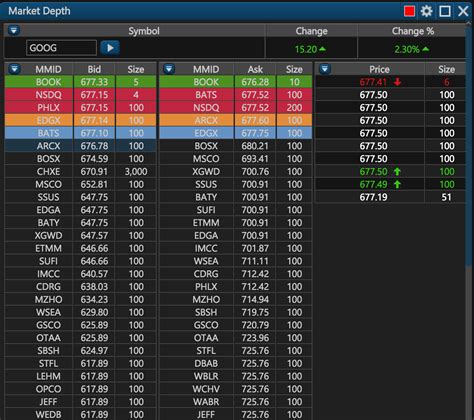

What is the market depth?

The market depth refers to the number of operations carried out in one second. It is calculated by measuring the time interval between two consecutive operations in an exchange of cryptocurrencies. The more business perform per unit of time, the deeper the market is. In other words, a deeper market has a higher commercial volume and a higher prices.

How does the Ethereum trade affect the market depth?

The market depth can significantly influence the commercial ETH performance in different ways:

- Price volatility : deep markets are usually less volatile because they are characterized by more frequent operations. This means that retailers can carry out their operations with greater trust, which leads to an average company for the company.

- Commercial volume : The high market depth is associated with a high commercial volume that increases prices and supports the commercial activities of the ETH.

- Liquidity : Tower markets offer retailers better liquidity because they enable the most common purchase and sale at competitive prices.

The effects of the market depth on trade volumes ETH

A coinmarketcap study showed that the depth of the ETH market has a significant impact on commercial volumes:

- For each 0.1 ETH unit that was negotiated per second (market depth), the volume increases by approx. 10%

- A lower market (for example with 100 times more operations per second) leads to an increase in the negotiation volume by 20% compared to a less deep market

The role of the market depth in the development of commercial strategy

Understanding the market depth is crucial to develop effective commercial strategies. Dealers can use the market depth analysis to determine potential opportunities and risks:

* Identify high volume operations : Search for operations with a high commercial volume, as they are most likely carried out.

* Recognize market trends : Analyze the general market trend to anticipate when a deeper market is approaching.

* Avoid overwriting : Pay attention to tradition in deep markets, which can lead to a reduction in performance and a higher risk.

Diploma

The market depth plays an important role in determining the commercial performance of ETH. By understanding how the market depth affects prices and volumes, retailers can make more informed decisions and develop effective strategies for success on the cryptocurrency market.

In summary, the market depth is a crucial factor that should not be overlooked when it comes to Ethereum (ETH). Traders who understand the importance of the market depth can be used for their advantage, while those who cannot be disadvantaged.

recommendations

* Use the market depth analysis

: Integrate the market depth analysis into your commercial strategy to identify potential opportunities and risks.

* Focus on high volume operations : Prioritize the operation with a high commercial volume to increase the possibilities of a successful execution.

* Stay up to date : Control the market trends continuously and adapt your strategies accordingly.

According to these recommendations, retailers can improve their performance on the cryptocurrency market and achieve success in the ETH trade.