Last technical analysis for successful cryptocurrency trading, usage manager

In the rapidly changing financial market, trading in cryptocurrencies can be of high risk, high risk efforts. With many altcoins, chips and other possible digital wealth, it is very important to understand the technical analysis to make reasonable investment decisions. In this article, we will examine the world of trading cryptocurrency and provide a comprehensive guide on how to use a technical analysis successfully.

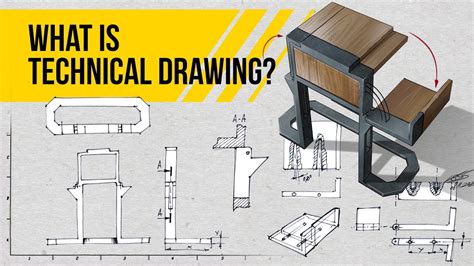

What is the technical analysis?

Technical analysis (TA) is a method of analysis of financial markets using charts, models and trends. These include setting models and relationships between price changes and other market indicators to provide future prices. It can be used to analyze both short -term and long -term behavior.

Why use technical analysis in cryptocurrency trading?

Cryptocurrencies are known for its high volatility and fluctuations, so technical analysis is an important tool for traders. Using a technical analysis, you can:

1

2.

- Avoid Overcoming : Technical analysis helps prevent possible trading options that cannot be confirmed by the main analysis.

- Handle Risk : Using a technical analysis to determine the risk reward relationships and determine the Stop-Loss level, you can manage your risk and reduce losses.

Basics of Technical Analysis

You will need a strong understanding of the following concepts to start with technical analysis:

- Chart Models : Identification of models such as head and shoulders, triangles and charts.

2.

- Reports : The use of ties such as mobile (MA), relative resistance index (RSI) and Bollinger tape to analyze market productivity.

- Time Analysis : Exploring graphics models and trends at different time intervals such as 1 minute, 5 minutes and day schedules.

Key cryptocurrency trading indicators

Here are some of the most important technical indicators used in the cryptocurrency of trade:

1

2.

- Bollinger bands : The strips spread around the moving medium to analyze volatility and impulse.

- Stocastic oscillator

: Calculation of the relationship between high and low prices to determine excessive or congested conditions.

How to successfully trade technical analysis

To effectively use technical analysis when selling cryptocurrency, follow the following steps:

- Select your indicators : Select a set of technical indicators that will match your investment goals and tolerance for risk.

2.

- Specify models : In your analysis you are looking for schemes and signals.

4.

- Observe your operations

: Constantly monitor your operations using real -time data flows.

Conclusion

Technical analysis is a powerful tool for cryptocurrency traders, allowing you to set trends, to predict prices and manage risks.