Dark Side of Cryptocurrency: Understanding of the Effects of Systemic Risk

Cryptocurrency Growth has caused significant changes in how people think and interact with money. From decentralized Finance (Defi) Programs to the Initial Coin Proposals (ICO), Cryptocurrency has become an integral part of the global economy. However, after this innovation, the surface is a complex risk network that threatens financial stability.

What is Systemic Risk?

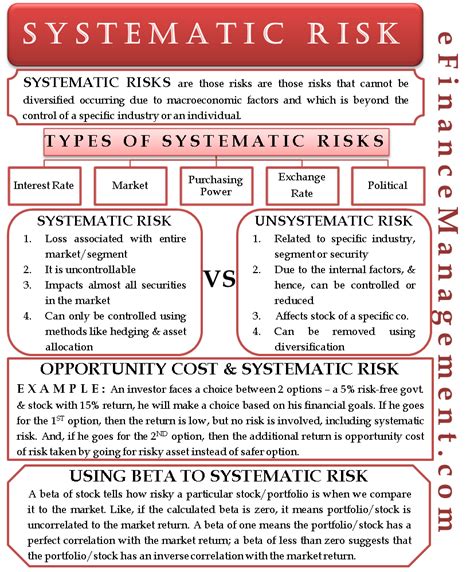

Systemic risk means the ability of a financial crisis or panic to disseminate and influence not only the directly affected assets, but also the entire Broader Financial System. In other words, the system risk is the risk that failure in one part of the financial system can cause extensive failures in several sectors.

Effect on Markets

Cryptocurrencies were linked to several high -Level marketing accidents:

1

- 2018: The spike of the volatility of the Cryptocurrency Market : When more institutions and individuals have entered the market, prices have risen only to destroy, when concerned for market volatility and regulatory uncertain uncertainty.

- 2020: The effect of the Covidid-19 Pandemic Cryptocurrency Market : Pandemia has imposed travel restrictions and locks during the pandemic, results in cryptocurrency markets.

Why is Systemic Risk Concerns about Cryptocurrencies?

Cryptocurrencies operate regardless of traditional financial systems, which means that their value is not directly related to any particularly property or market. However, this also means that they can be vulnerable to Systemic Risks If the Wider Market is suffering from Significant Disorders.

Basic Risks Associated With System Cryptocurrency Risk

1

2.

- Systemic Interconnection : Cryptocurrencies are often used as a means of exchange, and their extensive adopion has increased the connection in various markets, so systems risk is more likal.

Systemic risk reduced in cryptocurrency markets

While the risk associated with Cryptocurrency systems is significant, there are actions that can be taken to soffen them:

- Improved Regulation : Government and Regulatory Authorities should set clear guidelines and maintenance mechanisms to ensure cryptocurrency stability.

2.

- diversification strategies : Investors can diversify their portfolios by investing in a wealth of assets, including traditional traditional currencies, bonds and promotions.

Conclusion

Cryptocurrency may disrupt the financial world, but it has decentralized Nature also causes it to be vulnerable to system. As market participants continuing to surf this complex landscape, it is very important to understand the system in order on the markets in order to relieve potential risks and stability.

By recognizing the risks associated with cryptocurrency systems and taking measures to mitigate them, we can try to create a safer and more stable financial environment for all stakeholders involved in these market.