Unknown area of cryptocurrency trade: understanding the risks and market dynamics of Tron (TRX)

As the global economy moves towards digital currencies, the world of cryptocurrency trade increased exponentially. One of the most popular platforms of cryptocurrencies is the Tron Blockchain-based network, also known as TRON (TRX). In this article, we are immersed in the risks related to Tron trade and discover the value of market dynamics.

What is Tron?

Tron is a decentralized operating system (OS) built on top of the Ethereum blockchain. This allows you to create decentralized applications (Dapps), which have specific rules. The TRX, the platform is a native cryptocurrency, is used to pay transaction fees and encourage network activity.

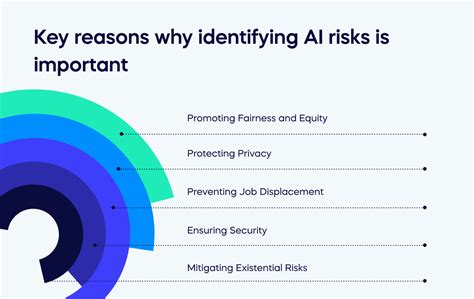

The risk of commerce on Tron

Although Tron has become popular in recent years, it is essential to understand the risks related to trading on the platform. Some key concerns are as follows:

- Security Risks : The decentralized nature of Tron makes attacks on hackers and malicious programs vulnerable. As a result, merchants must take further precautions to ensure accounts and funds.

- Market volatility : Like all other cryptocurrencies, TRX is subjected to market fluctuations. The value of TRX may be rapidly reduced due to factors such as changes in investor emotions or the general condition of the global economy.

- Liquidity Risks : TRON’s relatively small market capitalization (upper market limit) means that trading volume is limited, leading to liquidity problems and higher prices to buy or sell TRX.

- This uncertainty can affect investors’ confidence and market emotions.

market dynamics

The cryptocurrency market has experienced significant exchange rates in recent years due to various factors, such as:

- Village fluctuations : Changes in the supply of TRX or other cryptocurrencies may affect demand, which can result in rapid price increases or decreases.

- Acceptance and Use : Acceptance of Tron-based Dapps and TRX by users and developers may affect its value and market emotions.

- Global Economic Events : Economic downturns, recessions or global events such as Covid-19 Pandemic have influenced cryptocurrencies in the past, influencing the price of TRX.

- Regulatory Changes : Regulatory updates or changes in laws can affect investors’ confidence and market dynamics.

The key players

The key players affecting Tron’s market dynamics include:

- Tron Inc. : The company behind Tron, which is responsible for the development and maintenance of the platform.

- TRX token owners : Investors who own TRX tokens are often the most influential in developing the direction and value of the platform.

3.

Conclusion

Trade on Tron has unique risks that investors must be aware of. Although the platform has a chance to grow, trade with caution and a clear understanding of the dynamics of the game is essential. Through information on regulatory developments, market fluctuations and adoption trends, merchants can make more well -founded decisions and manage their risk exposure.

Recommendations

TRON Effective Trading:

- Research : A thorough understanding of platform technology, uses and regulatory landscape.

- Risk Management

: Set clean stop-loss and position sizes to alleviate potential losses.

3.